- Freebies: A Double-Edged Sword

- Freebies Politics

- Freebies v/s Welfare

Quotation

- Milton Friedman: – “There is no such thing as a free lunch.”

- Margaret Thatcher: – “The problem with socialism is that you eventually run out of other people’s money.”

Introduction

- Freebies and subsidies are common tools used by governments worldwide to support the vulnerable sections of society and stimulate economic activity.

- While subsidies are intended to make essential goods and services affordable, freebies often aim to win political favor.

- The debate over their efficacy and sustainability is both crucial and contentious, impacting economic policies and public welfare.

Facts (Current Stats)

India: In the 2022-23 budget, the Indian government allocated approximatel₹4.33 lakh crore for subsidies, including food, fertilizers, and petroleum.

USA: In 2021, the United States spent around $600 billion on subsidies, including agriculture, housing, and healthcare.

Global Context: According to the International Monetary Fund (IMF), global energy subsidies amounted to $5.2 trillion in 2017, or 6.5% of global GDP.

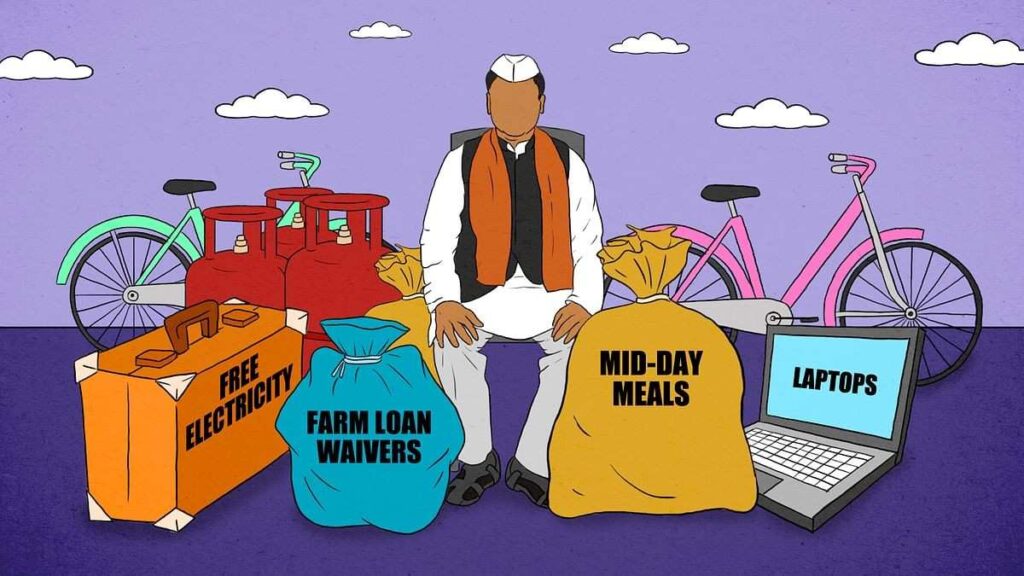

FREEBIES

- In a Reserve Bank of India report in 2022, freebies have been defined as “a public welfare measure that is provided free of charge”. It adds that freebies are different from public/merit goods such health and education, expenditure on which has wider and long-term benefits.

- Freebies are goods and services given free without any charge to the users.They are generally aimed at benefiting the targeted population in the short term.

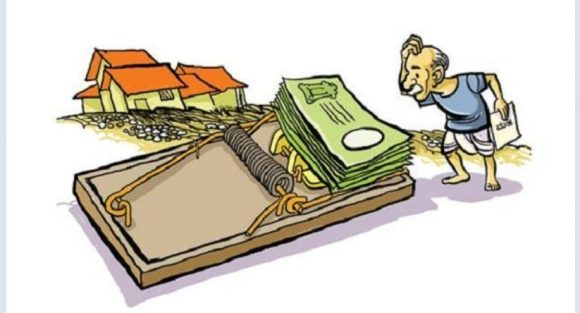

- They are often seen as a way of luring voters or bribing them with populist promises.

- Some examples of freebies are free laptops, TVs, bicycles, electricity, water, etc

Advantages of Freebies

- Public Outreach and Engagement: Government freebies can increase public trust and satisfaction.

- Freebies can stimulate economic growth by increasing the productive capacity of the workforce(A report by the NITI Aayog stated that freebies such as bicycles given to schoolgirls in Bihar and West Bengal increased their enrolment and retention rates, reduced dropout rates, and improved their learning outcomes.)

- Provide basic necessities and social welfare to the poor and marginalized sections of society.(A study by the World Bank estimated that freebies such as food subsidies under the Public Distribution System (PDS) reduced the poverty ratio in India by 7% in 2011-12.

- A survey by the NSSO revealed that freebies such as health insurance under the Rashtriya Swasthya Bima Yojana (RSBY) reduced the out-of-pocket expenditure and catastrophic health shocks for below poverty line households)

- Freebies can reduce income inequality and poverty by redistributing wealth and resources more equitably. For example, freebies such as loan waivers, or cash transfers can empower the indebted.

Disadvantages of Freebies

- Dependency Syndrome

- Fiscal Burden-Burden on exchequer

- Resource Misallocation (A report by the NITI Aayog criticised that freebies such as laptops given by the Uttar Pradesh government diverted funds from more urgent needs such as improving school infrastructure, teacher quality, or learning outcomes)

- Quality Compromise

- Impact on Environment (A report by the CAG revealed that free electricity for farmers in Punjab led to overuse and wastage of power, low tax compliance, and poor quality of service delivery by the state power utility)

Subsidy

- The term subsidy refers to financial assistance in the form of discounts or monetary grants by the Central government to public entities or private institutions.

- The objective is to make the products offered by these institutions affordable for public consumption.

- The subsidized products are necessary for the larger public good and are a means of supporting the community’s welfare.

Varieties of Subsidies

| Open ended Subsidy | Closed ended Subsidy |

|---|---|

|

Here, the price of the product will be fixed, and subsidy will be varying.

|

Here the subsidy will be fixed, hencethe value of the product will be varying.

|

|

For ex: Petrol price will be fixed at 100rs but govt subsidy will be varying because sometime Petrol price will be increasing or decreasing in International market accordingly subsidy will vary.

|

For ex: Petrol price will not be fixedbut govt subsidy will be fixed because of which sometime Petrol price will be increasing or decreasing as per International

market.

|

Types of Subsidies

| Direct subsidy | Indirect Subsidy |

|---|---|

|

Here amount will be directly paid to the citizen

|

Here amount will not be directlypaid but subsidy will be responsible for reduction of prices.

|

|

Direct benefit transfer

|

Minimum Support Price

|

|

Paying fees of the college

|

Fertiliser Subsidies

|

|

Farm loan waiver

|

Oil Subsidies

|

|

Ex: PM Kisan Samman Nidhi Scheme

|

Interest Subvention schemes

|

Rationale behind providing subsidies

- Poverty Alleviation

- Food Security

- Agriculture Support

- Education and Healthcare

- Export Promotion

- Fuel Subsidies

- Environmental Conservation

- Social Welfare

- Industrial Development

- Price Stabilization

Disadvantages of subsidies

- Shortage of supply

- Difficulty in measuring success

- Results in higher taxation

- Inefficient allocation of resources

- Distort markets, preventing efficient outcomes and diverting resources from more productive uses to less productive ones.

- Subsidies corrupt the political process.

Measures

Constitutional, Legislative, and Executive

- Constitutional Provisions: Article 38 and Article 39 of the Indian Constitution emphasize the state’s role in ensuring social and economic justice, indirectly supporting the provision of subsidies.

- Legislative Measures: Laws like the National Food Security Act, 2013, institutionalize subsidies for essential goods.

- Executive Actions: Government schemes like PM-KISAN and MGNREGA provide direct benefit transfers and employment guarantees, respectively.

Judgments

- Supreme Court of India: In S. Subramaniam Balaji vs State of Tamil Nadu (2013), the Court acknowledged the legality of election promises but stressed the need for financial discipline.

NGOs and Social Activists

- NGOs: Organizations like SEWA (Self Employed Women’s Association) work to empower women economically, reducing dependency on subsidies.

- Social Activists: Bezwada Wilson, through his work with Safai Karmachari Andolan, highlights the need for sustainable livelihood over freebies

NGOs and Social Activists

- WTO: The World Trade Organization regulates agricultural subsidies to prevent trade distortions.

- IMF and World Bank: These bodies advocate for subsidy reforms to ensure fiscal sustainability.

Freebies: A path to prosperity or poverty? Checkout freebies advantages and disadvantages

Case Study

Tamil Nadu’s Freebie Culture

- Tamil Nadu is known for its extensive use of freebies, from free laptops for students to subsidized food grains. While these measures have improved living standards and education levels, they have also led to significant fiscal deficits. The state’s debt-toGDP ratio stood at around 23.5% in 2021, raising concerns about long term sustainability.

Expert Committee Recommendations

- C. Rangarajan Committee: Recommended reducing subsidies to 1.5% of GDP to ensure fiscal discipline.

- Kelkar Committee: Emphasized targeted subsidies over blanket ones to improve efficiency and reduce wastage.

Way Forward

- Drawing a Line Between Welfare and Freebie

- Understanding the differences between subsidy and freebie are also essential

- Clear Rationale and Indication of Funds

- Empower the Election Commission of India:

- Voter Awareness

- Judicial Intervention (Supreme Court has suggested setting up an expert committee to look into the issue of freebies and their impact on the economy and democracy)

Focus on Inclusive Development

- Targeted Subsidies: Shifting from universal to targeted subsidies to ensure that only the needy benefit.

- Technology Integration: Using technology like Direct Benefit Transfer (DBT) to reduce leakages and ensure transparency.

- Public Awareness: Educating the public about the long-term impacts of freebies and fostering a culture of self-reliance.

- Policy Reforms: Implementing policy reforms that focus on sustainable development rather than short-term political gains.

- International Collaboration: Learning from best practices globally and collaborating with international bodies for sustainable subsidy frameworks.

Conclusion

- Subsidies and Freebies are essential instruments for social welfare and economic equilibrium but must be wielded with caution and prudence.

- The challenge lies in balancing immediate public needs with long-term fiscal health, ensuring that the tools meant for upliftment do not become shackles of dependency.

- As nations stride forward, crafting policies that foster sustainable development, empower individuals, and judiciously manage resources will be the cornerstone of a just and equitable society.

- The journey ahead demands good governance, informed citizenry, and a relentless pursuit of balanced progress.

- This comprehensive approach ensures that the welfare of the populace is not sacrificed at the sake of political expediency, thus forging a path towards a resilient and self-sustaining future.