Code on Wages, 2019

The Code on Wages, 2019, also known as the Wage Code, is an Act of the Parliament of India that consolidates the provisions of four labour laws concerning wage and bonus payments and makes universal the provisions for minimum wages and timely payment of wages for all workers in India.

The government of India began considering a plan in 2015 to consolidate India’s 44 labour laws into four codes in order to rationalize labour laws and improve ease of doing business. The other three are the Occupational Safety, Health and Working Conditions Code, the Industrial Relations Code, and the Code on Social Security.

The Code on Wages Bill, in turn, will subsume four laws:

- Minimum Wages Act. (MWA)

- Payment of Wages Act (PWA)

- Payment of Bonus Act .(PBA)

- Equal Remuneration Act.(ERA)

The bill was passed by the Rajya Sabha on 2 August 2019. The bill received assent from President Ram Nath Kovind on 8 August. The bill is a series of many labour reforms undertaken by the Government of India.

What changes will the Code on Wages Bill bring?

As per Labour Minister Santosh Kumar Gangwara, the new law will benefit about 50 crore workers in the country.

- In addition, other changes will also become available:

- As per the bill, a committee of trade unions, employers and the state government will fix a floor wage for workers throughout the country.

- Provident fund (PF) and gratuity components and take-home pay of employees will be impacted. The new definition of wages caps allowances at 50% of total compensation.

- The basic pay will be 50% or more of total pay as per the new code. This will change the salary structure of most employees as the non-allowance part is usually lower than 50%.

- As provident funds (PF) are based around basic salary, it will go up, which means that the take-home pay will come down.

- Post-retirement pay-out will go higher due to higher contributions due to provident funds

- Companies will also see their cost rise as the contribution towards PF and gratuity increases.

Types of Wages

- Minimum Wage: International Labour Organisation defines it as “the minimum amount of remuneration that an employer is required to pay wage earners for the work performed during a given period, which cannot be reduced by collective agreement or an individual contract”.

- The minimum wage includes the bare needs of life like food, shelter, and clothing.

- Living Wage: It is the wage needed to provide the minimum income necessary to pay for basic needs based on the cost of living in a specific community.

- In addition to bare needs, a ‘living wage’ includes education, health, insurance, etc.

- Fair Wage: A ‘fair wage’ is a mean between ‘living wage’ and ‘minimum wage’.

- Starvation Wage: It refers to the wages which are insufficient to provide the ordinary necessities of life.

Salient Features of Code on Wages Bill

The following are some of the features of the Code on Wages Bill, 2019:

- Uniform Applicability: The Wage Code now will ensure uniform applicability of the timely payment of wages. Irrespective of wage ceilings and different industrial sectors when previous laws like the Payment of Wages Act, Minimum Wages Act had placed restrictions.

- Uniform Definition of Wages: The definition of ‘wages’ slightly varied across PWA, MWA, PBA and this has resulted in numerous litigations. Therefore, the Wage Code seeks to provide a single uniform definition of ‘wages’ for the purposes of computation and payment of wages to the employees. As per Wage Code, the term ‘wages’ means all remuneration whether, by way of salaries, allowances or otherwise, expressed in terms of money and includes basic pay; dearness allowance; and retaining allowance if any.

- The distinction between Employee and Worker: The Wage Code provides separate definitions of ‘worker’ and ‘employee’. The definition of ‘employee’ is broader than that of ‘worker’.

- Equal Remuneration: The Wage Code prohibits discrimination on the ground of gender with respect to wages by employers or for purpose of recruitment, with respect to the same or work of similar nature of work.

- Payment of Bonus: There is no significant change from PBA and the provisions relating to the payment of bonus are also consistent with the terms of PBA. Earlier, the applicability was limited to employees drawing wages not exceeding INR 21,000 per month. Now, under the Wage Code, the appropriate government is empowered to fix the wage threshold for determining the applicability.

Overview of the new code:

The new code will amalgamate the Payment of Wages Act, 1936, the Minimum Wages Act, 1948, the Payment of Bonus Act, 1965, and the Equal Remuneration Act, 1976.

- Coverage: The Code will apply to all employees. The central government will make wage-related decisions for employments such as railways, mines, and oil fields, among others. State governments will make decisions for all other employments.

- Wages include salary, allowance, or any other component expressed in monetary terms. This does not include bonus payable to employees or any travelling allowance, among others.

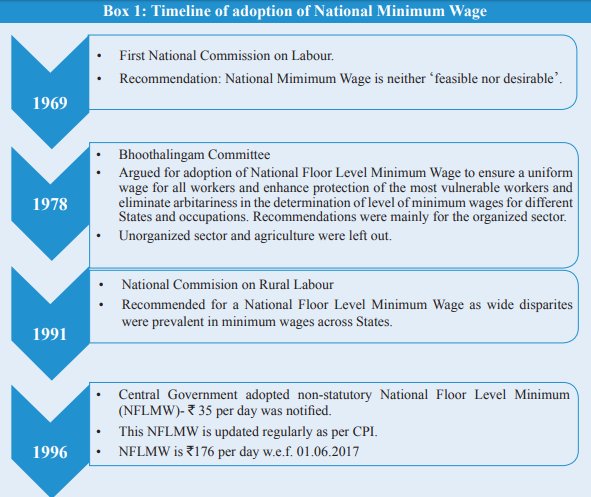

- Floor wage: According to the Code, the central government will fix a floor wage, taking into account living standards of workers. Further, it may set different floor wages for different geographical areas. Before fixing the floor wage, the central government may obtain the advice of the Central Advisory Board and may consult with state governments.

- The minimum wages decided by the central or state governments must be higher than the floor wage. In case the existing minimum wages fixed by the central or state governments are higher than the floor wage, they cannot reduce the minimum wages.

- Payment of wages: Wages will be paid in (i) coins, (ii) currency notes, (iii) by cheque, (iv) by crediting to the bank account, or (v) through electronic mode. The wage period will be fixed by the employer as either: (i) daily, (ii) weekly, (iii) fortnightly, or (iv) monthly.

- Deductions: Under the Code, an employee’s wages may be deducted on certain grounds including: (i) fines, (ii) absence from duty, (iii) accommodation given by the employer, or (iv) recovery of advances given to the employee, among others. These deductions should not exceed 50% of the employee’s total wage.

- Gender discrimination: The Code prohibits gender discrimination in matters related to wages and recruitment of employees for the same work or work of similar nature.

- Advisory boards: The central and state governments will constitute advisory boards. The Central Advisory Board will consist of: (i) employers, (ii) employees (in equal number as employers), (iii) independent persons, and (iv) five representatives of state governments. State Advisory Boards will consist of employers, employees, and independent persons. Further, one-third of the total members on both the central and state Boards will be women. The Boards will advise the respective governments on various issues including: (i) fixation of minimum wages, and (ii) increasing employment opportunities for women.

Significance:

- This is expected to effectively reduce the number of minimum wage rates across the country to 300 from about 2,500 minimum wage rates at present.

- Codification of labour laws will remove the multiplicity of definitions and authorities, leading to ease of compliance without compromising wage security and social security to workers.

- It is expected to provide for an appellate authority between the claim authority and the judicial forum which will lead to speedy, cheaper and efficient redressal of grievances and settlement of claims as that of earlier.

Concerns with New Wage Code

- Starvation Wages: It has been alleged that the new wage code will push the starvation wages further by increasing the income capacity and purchasing power of the informal workers.

- The increase in purchasing power of the workers will lead to the decrease in savings which inturn will reduce expenditure for productive purposes.

- The introduction of concept of“floor wages” would mean that “starvation wages” which currently guarantees just ₹178 per day, will continue to exist and would promote forced labour.

- This has been highlighted by Supreme Court in his judgement in Unichoyi and Others vs. The State of Kerala case,where it remarked that in an underdeveloped country which faces the problem of unemployment on a very large scale, it is likely that labour offers to work even on starvation wages.

- Deduction of Wages Clause: The new law provides for the arbitrary deduction of wages (upto 50% of monthly wage) based on performance, damage or loss, advances etc.

- The deduction clause will lead to reduced bargaining power and right of association of workers. The workers will not be able to demand even basic work rights in fear of wage deduction.

- In India, the informal sector employers dominate the workers due to caste and higher social status, therefore the above provision may have the potential to become a handy tool for exploitation of these workers.

- In Raptakos case(1991), the Supreme Court advocated the concept and the right of living wage.

- “Consumer Expenditure Survey” result shows that the average family expenditure in rural areas to be ₹83 per day and in urban areas as ₹134 per day.

- Inspection Framework: The rules do not clarify the governance and institutional structure for “labour inspection system”. The rules propose an ad-hoc unclear mechanism called “inspection scheme”.

- The scheme provides for appointment of Inspector-cum- Facilator by notification by the appropriate government. This may lead to the revival of inspector-raj system in the labour market.

- The International Labour Organisation’s (ILO) Labour Inspection Convention of 1947 (Convention C081) —which has been ratified by India — provides for a well-resourced and independent inspectorate with provisions to allow thorough inspections and free access to workplaces. However, the provisions of ILO’s convention has been overlooked while framing the new law.

Way Forward

- The government should focus on “Need Based Minimum Wage” covering nutrition, healthcare, education, housing and provisions of old-age. Therefore, guaranteed minimum wage should be treated as a fundamental constitutional right for every citizen of India.

- According to the new law, the revision of minimum wages is to be done after every5 year, which is quite a long period considering the volatility in the market. Therefore, minimum wages should be adjusted to inflation so as to align the wages to market volatility.

- The National Commission for Labours should be formed to streamline the issues and challenges of labour market and fixing discrepancies in national level minimum wage computation.

Conclusion

One argument for a national minimum wage is to ensure a uniform standard of living across the country. At present, there are differences in minimum wages across states and regions. Such differences are attributed to the fact that both the central and state governments set, revise and enforce minimum wages for the employments covered by them. The introduction of a national minimum wage may help reduce these differences and provide a basic standard of living for all employees across the country.

For the minimum wage system to play a meaningful role in aligning protection with the promotion of sustainable growth, it must be properly designed, its goals clarified, and its enforcement made effective.